Listing on ASX provides access to public-market investor capital at an earlier stage than on other major international exchanges. More than 230 international companies from the United States, New Zealand, the United Kingdom, Canada and Singapore, are leveraging an ASX listing to support and fund their growth ambitions.

Several considerations influence when to list and on which exchange. They include company maturity, valuation, investor access, index inclusion and the ability to raise additional capital. These are areas where ASX provides a globally compelling offering.

Benefits of main board listing

ASX only offers a main board listing, with unrivalled access to investment capital for small and mid-caps. This differs from other global markets, which are structured with a second board to offer a listing opportunity to earlier-stage companies that in time will need to graduate to a main board.

A key constraint to a secondary-board listing is access to capital and institutional investors with long-term investment horizons. Many asset-owner mandates only permit institutional investors to invest in companies listed on a globally recognised exchange, for which a secondary board does not qualify.

A single main board works for ASX as there is a robust but adaptive corporate governance regime that is principles-based and progresses as a company matures on the market.

Listing in Australia is neither as costly nor as arduous in terms of regulation as the US exchanges, with a key difference being semi-annual versus quarterly financial reporting.

However, being a public company requires a level of maturity to comply with corporate governance and continuous disclosure requirements, as well as allowing key C-suite members to dedicate time to investor relations without affecting the underlying business operations.

A key benefit of going public is to collapse the “capital table” (the securities a company has issued and who owns them). When listing at the right point in the growth journey, this can allow early investors and founders to realise some equity and liquidity.

SiteMinder (ASX: SDR), a global provider of hotel-booking software, raised $626 million as part of its $1.36 billion listing on ASX in November 2021. This capital helped fund Siteminder’s continued growth trajectory but also allowed some early investors to exit, including Silicon Valley-based venture capital firm TCV, which originally invested in the business in 2013.

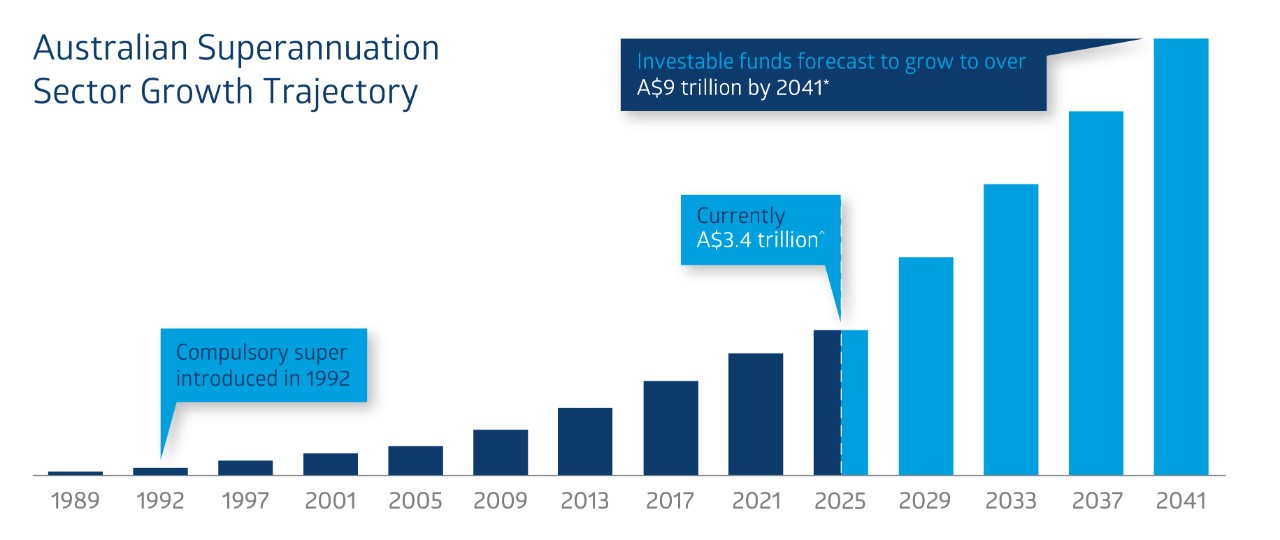

Capital access

An ASX listing also provides access to the world’s fifth-largest pool of pension assets, currently $3.5 trillion and predicted to grow to more than $9 trillion by 2041[i]. This results from the compulsory pension contributions introduced by the Australian government in 1992 that has created one of the world’s the fastest-growing pension pools. A significant amount of this pool is allocated to ASX-listed securities across a diverse range of investment mandates.

^APRA: Quarterly superannuation performance statistics highlights, September 2021. *Deloitte: Dynamics of the Australian Superannuation System, December 2021

The Australian market boasts an investor base that supports growth companies, is keen to invest in capital appreciation, and that understands the needs of earlier-stage companies to reinvest earnings into future growth. This sets ASX apart from some other international markets where the investment thesis sways more naturally towards dividend-yielding stocks and lower risk-profile investments. The risk/reward profile of investing in emerging technology companies has similarities with earlier-stage mining-exploration investment, the historical backbone of the Australian market, which is still an important sector for domestic and international listings.

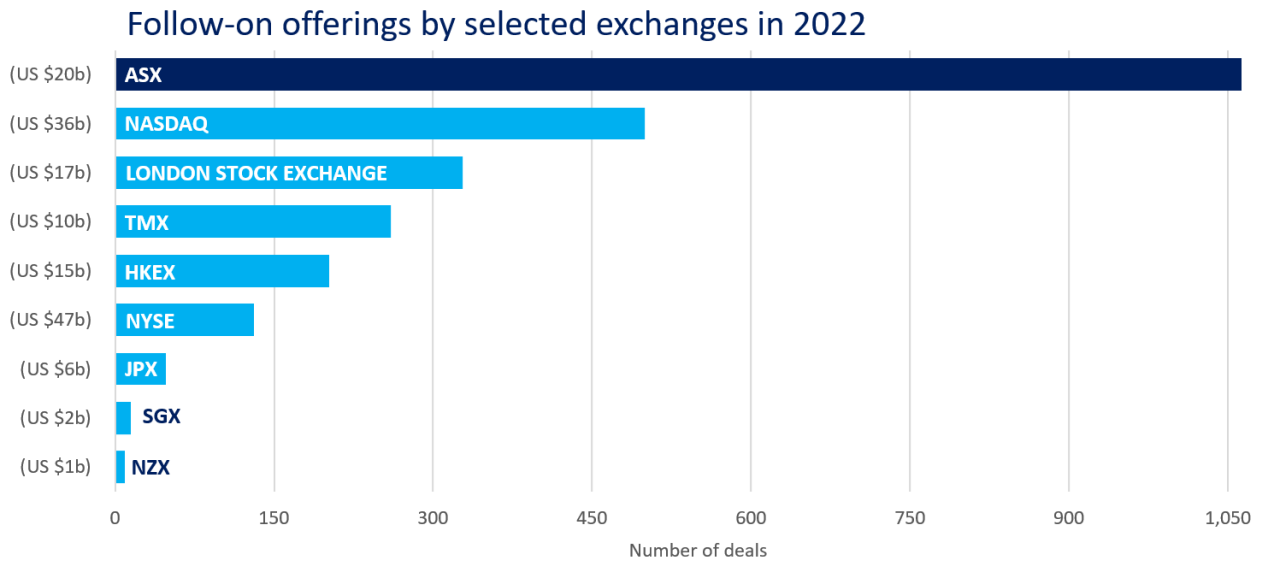

Important considerations for a newly listed company are access to follow-on capital and index inclusion. The start of the global pandemic in 2020 marked a period of uncertainty and heightened volatility for public markets. Many companies globally needed to raise additional funding either to strengthen corporate balance sheets or take advantage of the growth opportunities - particularly in the tech and healthcare sectors - that the dramatically changing world presented. Annually from 2020 - 2022, ASX was the leading exchange globally in terms of volume of secondary offerings, which validates the availability of capital in the Australian market to fund growth or strengthen high-quality companies when required.

Source: Dealogic, 1 January to 31 December 2022; values in brackets show capital raised in USD. Includes placements, SPPs, rights issues. Excludes block trades, convertibles, DRPs, employee share schemes; capital raised apportioned by exchange where applicable

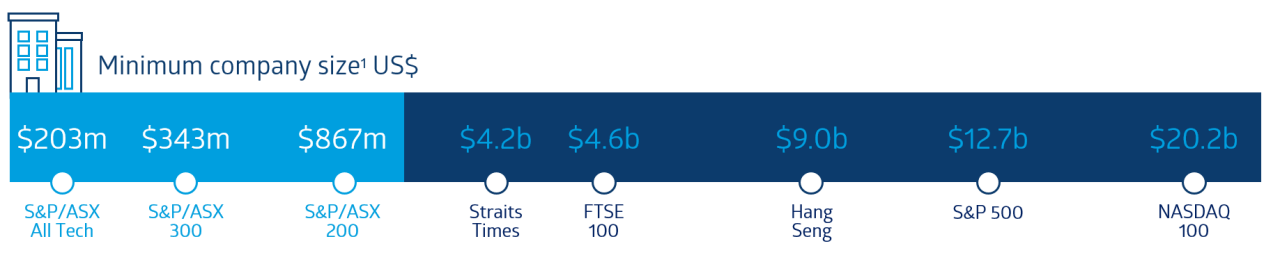

ASX offers earlier entry into globally recognised S&P indices, including the S&P/ASX 200, S&P/ASX 300 and S&P/ASX All Technology index. This attracts international investment support. For example, 40% of the institutional investors in the S&P/ASX 200 index are based outside Australia. Half are from the US, which demonstrates foreign companies can also attract investment from their home markets by listing on ASX.

Access benchmark indicies at a comparatively early stage

Source: ASX. *indicative values based on eligibility criteria or inclusions as at last rebalance. 'Company size' is total market cap.

US company Life360 Inc (ASX: 360) listed on ASX in May 2019, raising $100 million. Chris Hulls, co-founder and CEO, recently said: “We would rather be a well-respected and established company on ASX than one on NASDAQ but orphaned.”

Since listing, Life360 has moved through the milestones of index inclusion, entering the S&P/ASX All Ordinaries index in June 2020; the S&P/ASX 300 in June 2021; and the S&P/ASX 200 index in December 2021. Life360, like other fast-growing tech companies, might look to the US exchanges for a listing in future. This would be a natural stepping stone for a US company to list “back at home”. However, Hulls adds: “The other thing is we want to do right by the investors who funded us. Many have mandates that don’t allow them to hold our shares, should we move to the US. Obviously, in the long term, a US listing is right for the business. But we are very hesitant to do any sort of transaction that would mean investors would have to sell or want to sell.”

A domestic success story is Buy-Now, Pay-Later provider Afterpay, which listed on ASX with a market capitalisation of $165 million in 2016 and was acquired by Block Inc in late 2021 in a deal worth US$29 billion. Block (ASX: SQ2) has since dual listed on ASX, in a show of support for the Australian investors and further validation of the maturity of the ASX-listed tech sector.

Valuations, not getting lost

Much has been said about the growth of private funding in the Australian tech ecosystem in the last five years. This has allowed ever-increasing numbers of tech companies to flourish and has seen Australian startups attract the attention of and funding from the international VC community with larger cheque sizes. This raises the question of when a company might consider a US listing rather than a local listing.

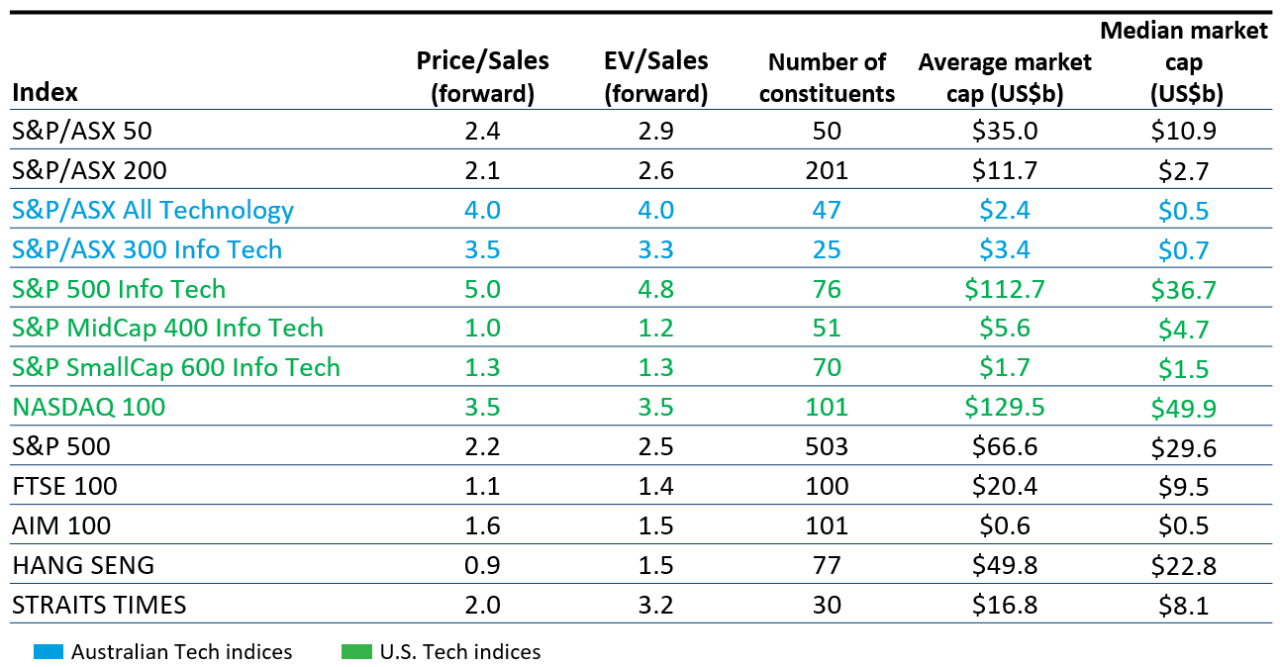

Valuations on ASX are competitive globally, particularly in the tech sector. A degree of scarcity in Australia is one of the reasons for some heightened valuations as competition exists among investors to diversify across sectors and geography and own quality growth assets.

As the table below shows, valuations for tech companies in the S&P 500 index in the US continue to lead the field globally. However, a company needs to achieve a minimum market capitalisation of US$12.7 billion to enter this index, so it is reserved for the global tech giants.

Below the S&P 500 level in the mid-cap and small-cap indices - where the market capitalisations compare more directly with ASX listings - there is a valuation premium in the ASX equivalent indices. An ASX listing for Australian and international companies is compelling from both a valuation and investor profile perspective from Series C (capital raising) onwards until arguably a valuation above US$10 billion.

So, on ASX, a small to mid-cap growth company can access investors and achieve similar valuations generated by large-cap US-listed companies.

Index composition and valuation indicators

Source: Bloomberg, 31 December 2022

An example is Xero’s decision (ASX: XRO) to move to a sole listing on ASX in 2018. Xero, a New Zealand accounting-software company, was previously dual listed on ASX and NZX. It wanted to consolidate to a single listing, so conducted a global review of exchanges, including the US markets. Xero concluded that with a market capitalisation of $12.7 billion at the time, it would achieve increased liquidity, increased relevance to a more diverse range of larger investors and broader analyst and broker coverage on ASX. The consolidation resulted in Xero entering the S&P ASX 100 index and it has since joined the S&P/ASX All Technology and S&P/ASX 50 indices. The market capitalisation of Xero is now above $14 billion[ii].

Conclusion

Competition for companies going public has become an ever-increasingly global playing field. The benefits of an ASX listing for the many high-quality growth companies, Australian and international, are compelling from a peer-group, valuation and investor-profile perspective.

Sources:

[i] (Source: APRA & Deloitte)

[ii] At 1 June 2023

Where to now?

For more information contact ASX Listings Business Development